🚀 Getting Started with Family Budget Tracker

Welcome! This guide will help you set up your account and start tracking your finances accurately.

Step 1: Create Your Account

- Go to family-budget.digraw.xyz

- Click "Sign Up"

- Enter your email and create a password

- Verify your email (check spam folder if needed)

- Log in to your new account

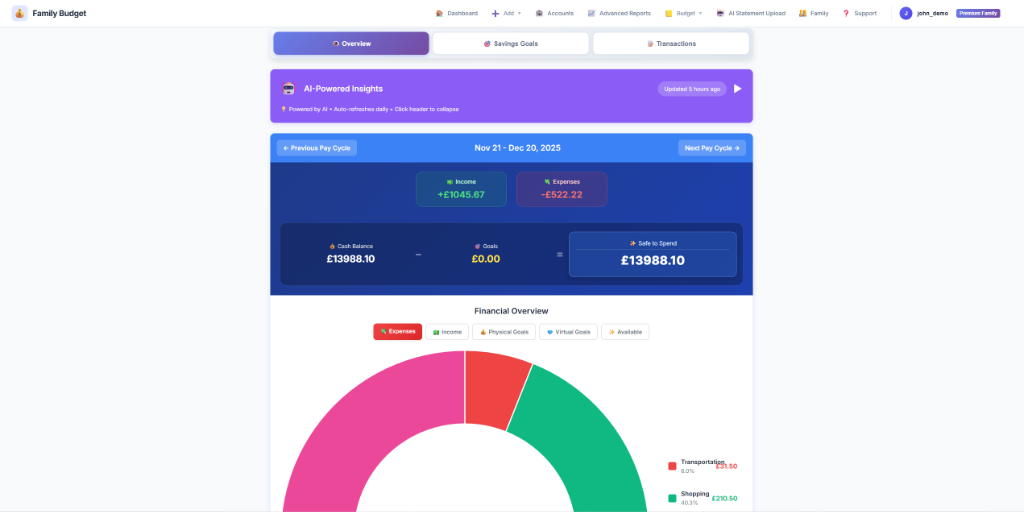

Step 2: Set Up Your Pay Cycle

Tell us when you get paid so we can track your budget accurately.

- Go to Settings → Pay Cycle Settings

- Choose your pay frequency:

- Weekly - Every 7 days

- Bi-weekly - Every 14 days

- Monthly - Once per month

- Set your Pay Day (e.g., "16" for 16th of month)

- Click "Save"

Step 3: Add Your Bank Accounts

Add all accounts you want to track. Precision is key here for accurate "Safe to Spend" calculations.

- Go to Accounts in the navigation

- Click "+ Add Account"

- Fill in:

- Account Name (e.g., "Chase Checking")

- Account Type (Bank Account or Credit Card)

- Currency (USD, GBP, EUR, etc.)

- Initial Balance & Date:

- CRITICAL: This must be the actual bank balance on the date you select.

- Example: If you start uploading statements from June 19th, enter the Closing Balance of June 18th as your initial balance, and set the date to June 18th.

- Bank Accounts: Use positive numbers (e.g., 5000)

- Credit Cards: Use negative numbers for debt (e.g., -1200)

- Budgeting Account Checkbox:

- Check this for cash-flow accounts (Checking, Credit Cards).

- Uncheck for investment or mortgage accounts (assets that don't affect daily spending).

- Click "Add Account"

Step 4: Upload Your First Statement & Get Insights (Premium)

Let AI extract transactions automatically. Premium Solo includes 15 uploads/month and Premium Family includes 30 uploads/month.

How to Upload:

- Go to AI Statement Upload

- Click "Upload Statement"

- Select your account

- Upload your PDF or image (Max ~10 pages recommended)

- Wait for AI processing and validation.

Validation & Scoring:

- 100% Score: Perfect match! (Opening Balance + Transactions = Closing Summary Balance)

- < 70% Score: Usually means the Account Summary table is missing or unreadable. You will likely need to manually check transactions.

- Correction Process:

- Check the number of transactions detected vs your statement.

- Double-check categories and descriptions.

- If the result is poor, delete the statement and try uploading again (clear image/scan).

- If correct, click "Confirm & Add" to save to your ledger.

Step 5: Set Budget Limits

Define spending limits for each category to get alerts.

- Go to Budget → Budget Limits

- Click "+ Add Budget Limit"

- Select a category (e.g., "Groceries")

- Set your monthly limit

- Click "Save"

Step 6: Create Savings Goals

Track progress toward financial targets.

Physical Goals (Separate Account)

- Use this when you transfer money to a non-budgeting savings account.

- To Fund: Upload the statement for the target account OR use the Fund Transfer button.

- Manual Fund Transfer:

- Click "Fund Transfer" on the goal card.

- Select the date (match your bank statement).

- Important: If the transaction already exists in your uploaded Source Account statement (as a debit), uncheck the "Source Side" box. Only check "Target Side". This prevents duplicate transactions.

- If no statement exists for either side, check both boxes to create both debit and credit transactions.

Virtual Goals (Mental Allocation)

- Use this to "earmark" money that stays in your checking account.

- To Fund: Click "Quick Fund".

- Select the date and amount.

- This instantly creates an internal allocation transaction and reduces your "Safe to Spend" without moving actual money.

Recurring Goals Note

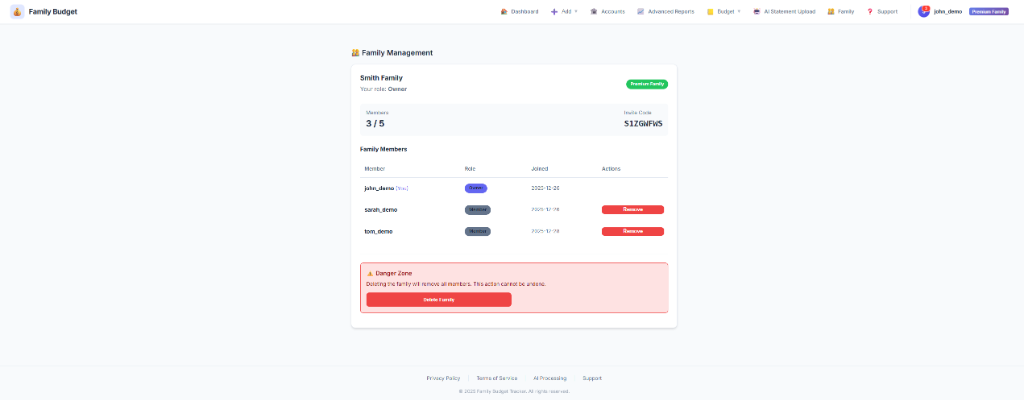

Step 7: Invite Family

Share budgets and track finances together. Both Free and Premium plans support families!

- Go to Family in navigation

- Click "Create Family"

- Share the invite code with your family.

Compare Family Plans

Choose the plan that fits your family's needs:

| Feature | Free Family | Premium Family |

|---|---|---|

| Family Members | Up to 5 members | Up to 5 members |

| Shared Features | ✅ Shared Dashboard & Goals | ✅ Shared Dashboard & Goals |

| Notifications | ✅ In-App Alerts | ✅ In-App Alerts |

| Recurring Txns | Limited (10/mo) | Unlimited |

| Accounts | 1 Account per person | Unlimited Accounts per person |

| Reports | Basic (Income vs Expense) | Full Analytics |

| Data Export | ❌ | ✅ Transaction CSV Export |

| AI Upload & Insights | ❌ Manual Entry Only | ✅ Auto-Extract + Daily Insights |

🎉 You're All Set!

Congratulations! You've completed the setup.

Need Help?

Email us at support@digraw.xyz - we respond within 24 hours!